are funeral expenses tax deductible uk

Get the latest headlines on Wall Street and international economies money news personal finance the stock market indexes including Dow Jones NASDAQ and more. A corporation can be a beneficiary of a life insurance policy.

Are Funeral Expenses Tax Deductible

In the world of taxes tax deductibles are one of the few things that work in the favor of the taxpayer and reduce taxes for both.

. Vacation travel expenses are most likely to be considered a luxury and not a need. Beneficially any resident who incurs extraordinary expenses may also obtain some tax relief. Insurance is a means of protection from financial loss.

These unavoidable expenses include funeral costs stays at Austrian hospitals and special medical treatments. Premiums are tax deductible as a business expense. Julians annual contributions to his retirement are not tax-deductible but his earnings accumulate tax-free.

The super you withdraw is paid and taxed as a normal super lump sum. For example if you collect 600week and your interest costs. Funerary customs comprise the complex of beliefs and practices used by a culture to remember and respect the dead from interment to various monuments prayers and rituals undertaken in their honor.

Tax-deductible is an expense that can be subtracted from the taxpayers gross income to get adjustable gross income reducing the tax liabilityWhen taxable income is reduced you pay less tax. Before that the expenses for the old-age provision can be claimed for tax purposes. This means the tax owing on your rental income cannot be reduced by mortgages effectively increasing the taxable amount from each residential property.

If you itemize deductions on Schedule A of your federal income tax return you can generally deduct the interest that you pay on debt resulting from a loan used to buy build or improve your home provided that the loan is. HSA Contribution Limits in 2021 and 2022 Making the most of health savings accounts means knowing the. It also pays for other expenses like lost wages funeral expenses and replacement services you cant do because of injuries like cleaning services or child care.

In most cases the premiums are not deductible but they can still be financed by corporate dollars which is better than using after-tax personal dollars. One of the most important tax benefits that comes with owning a home is the fact that you may be able to deduct any mortgage interest that you pay. Due to new legislation released in 2021 interest expenses eg.

The conversion includes pensions from the statutory pension insurance the agricultural old-age fund the professional pension institutions and from basic pension contracts so-called Rürup pensions. Mortgage costs are no longer tax-deductible on rental properties. Expenses like co.

Income tax is a type of tax you pay to the government on income earned from a job or your investments such as shares and ETFs. What Does Tax-Deductible Mean. Your super fund will automatically deduct the tax from your super account.

Income Tax 101 with our easy to use calculator and tax guides. Learn the Basics. Future Advantage Top-Up is a high deductible health insurance plan which pays for inpatient medical expenses in excess of the prescribed deductible limit.

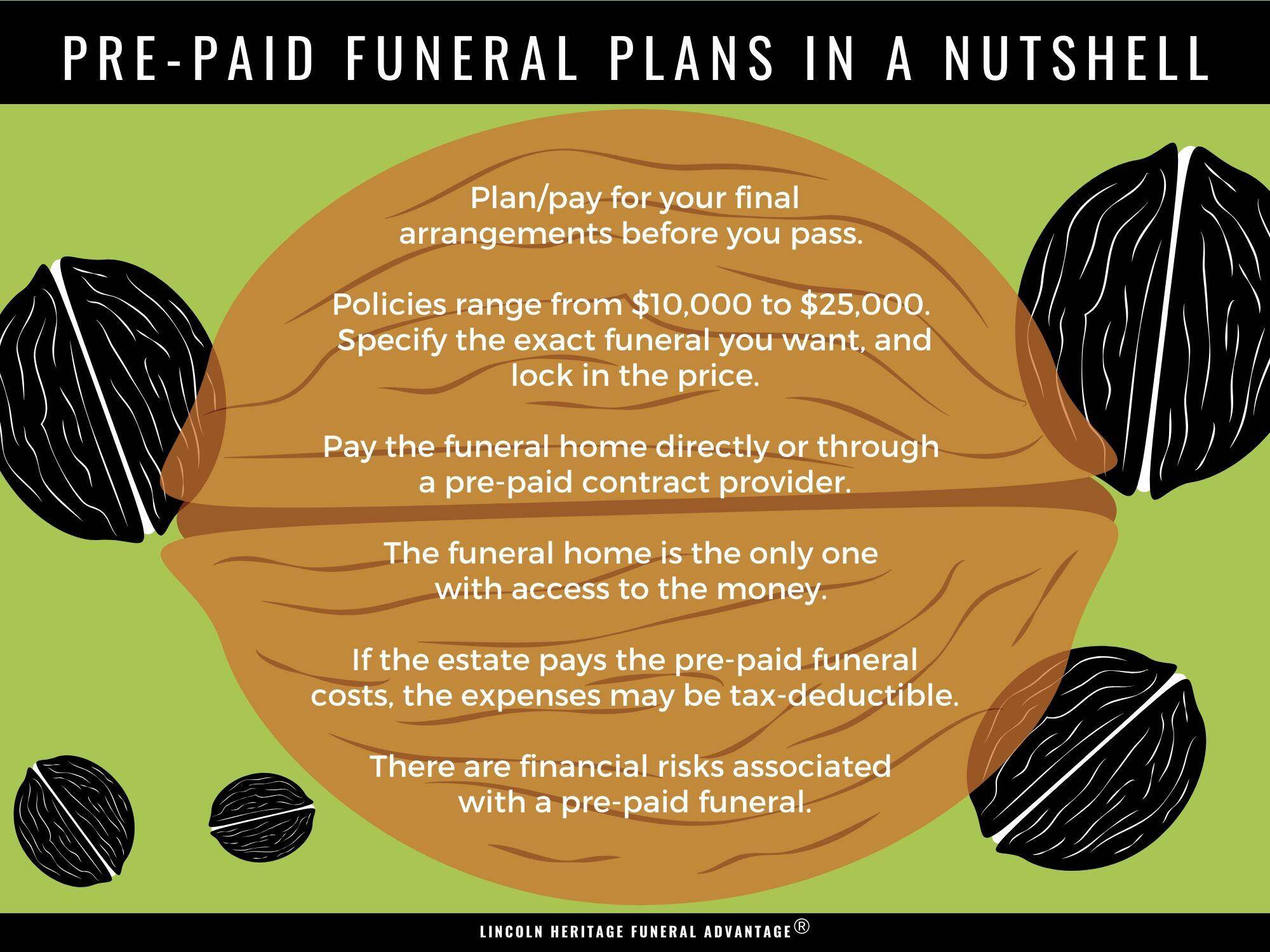

He is investing in a A. The tax rate depends on various factors including your age and the components of the super lump sum. Help your family cover the costs of your funeral and provide financial assistance to them in the event of your death.

Keeping your current large house will be cheaper to maintain than a move to a smaller house. Travel expenses for family to come to the funeral. The deductible will apply on aggregate basis towards hospitalisation expenses incurred during the policy period.

Expenses associated with the death funeral or burial of your dependant. A funeral is a ceremony connected with the final disposition of a corpse such as a burial or cremation with the attendant observances. This generally allows the corporation to pay the premiums for that policy and collect proceeds upon the death of the covered person.

Depending on income and family status the taxpayer may be able to deduct an amount that exceeds a certain percentage of ones income. An entity which provides insurance is known as an insurer an insurance company an insurance carrier or an underwriterA person or entity who buys insurance is known as a policyholder while a person. Customs vary between cultures.

What is income tax. It is a form of risk management primarily used to hedge against the risk of a contingent or uncertain loss. Health savings accounts can help you pay for your medical expenses with pre-tax money.

Vacation travel expenses There are many legitimate need-based expenses that can be paid by life insurance proceeds from groceries to retirement income. Such as emergency medical expenses cancelled or delayed flights lost or stolen luggage and personal liabilities should. Be informed and get ahead with.

Alabama allows you to deduct the portion of your medical and dental expenses that is more than 4 of the total Alabama AGI youve spent on those items during the 2021 tax year. Stock Market News - Financial News - MarketWatch. Investments should be evaluated to determine whether their income can help cover living expenses.

Income tax is worked out based on what you earn in a financial year such as from 1 July 2021 to 30 June 2022 FY2122 and any tax deductions or tax offsets you can claim during that time.

New Laws You Should Know About This Tax Season Wrsp

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

How Much Should You Donate To Charity District Capital

What Does Tax Deductible Mean Definition Examples And More

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Tax Deductions In Italy Financial Advice In Rome Italy

How Prepaid Funeral Plans Work Costs Expenses Pros Cons

Make Use Of All Those Tax Deductions Germany Has To Offer Sib

Donations Are Tax Deductible All Donors Will Be Entered In A Drawing To Win An Amazon Fire Tablet With 16 Gb In The Color O Special Olympics Olympics Special

How To Maximize Your Tax Deductible Donations Forbes Advisor

What All Gets Deducted From Your Monthly Salary Quora

Can You Deduct The Costs Of Estate Planning On Your Taxes

Which Expenses Are Deductible In 2020

Are Funeral Expenses Tax Deductible

Why Tax Deductions Are So Important For Your Business Tax Write Offs Business Finance Business Tax

Request Our Guide To Understanding Your Insurance Co Insurance Health Information Management Medical Social Work

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Are Funeral Expenses Tax Deductible

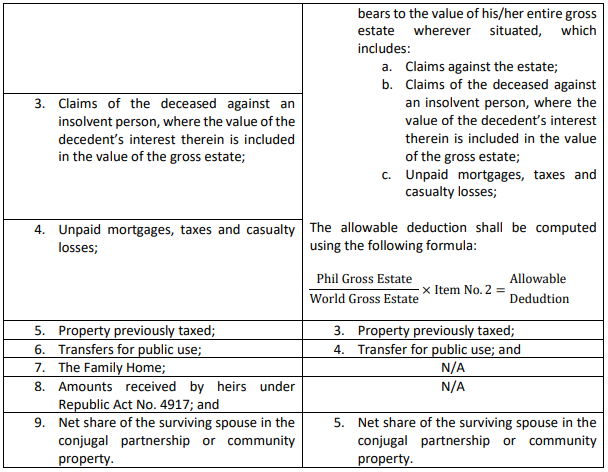

The Unspoken Cost Of Dying A Summary Of Philippine Taxes After Life Lexology